Unlock Success in Korean Company Acquisition

Tailored Buy-side M&A Advisory in Korea to Increase M&A Success by 90%

JCinus Partners simplifies every step of the Korean company acquisition process,

providing strategic advisory and seamless post-merger integration to boost your success.

Tailored Solutions for Korean Company Acquisition

JCinus Partners specialises in Korean company acquisition.

JCinus Partners specialises in Korean company acquisition, providing comprehensive buy-side M&A advisory in Korea to help foreign companies confidently acquire Korean companies. With our extensive experience and strategic approach, we ensure that each transaction creates maximum value and drives long-term growth for our clients.

Our team delivers bespoke solutions for every phase of the Korean company acquisition process, including target identification, valuation, negotiation, and post-merger integration. At JCinus, we simplify the complexities of the Korean market and position your business for seamless and successful acquisitions.

Why JCinus Stands Out in Korean Company Acquisition?

We are Korean M&A specialists in the UK.

1. Unmatched Expertise in Korean Company Acquisition

✔ JCinus Partners has guided numerous clients through transactions ranging from $50 million to over $500 million.

✔ Our experienced team provides unparalleled support throughout the entire buy-side M&A advisory process in Korea, ensuring a smooth and effective transaction.

2. Exclusive Deal Sourcing for Acquiring Korean Companies

✔ Leveraging a robust local network and proprietary deal pipelines, we uncover high-potential opportunities for company acquisition that are often unavailable on public markets.

✔ By connecting directly with key stakeholders, we help you acquire Korean companies that perfectly align with your strategic goals.

3. Customised Strategies for Successful Acquisitions

✔ We craft bespoke strategies tailored to your unique business needs, whether you aim to enter the Korean market, secure cutting-edge technologies, or expand your global footprint through a Korean company acquisition.

✔ Our deep market insights ensure your objectives are achieved through a carefully managed and customised approach.

4. Precision in Execution

✔ JCinus excels in delivering flawless execution, from the initial phases of acquisition advisory Korea to the final stages of closing.

✔ Our end-to-end support ensures every aspect of your Korean company acquisition is handled with care and precision.

Your Trusted Partner for Buy-side M&A in Korea

JCinus Partners is dedicated to ensuring your success in Korean company acquisition through meticulous planning, strategic execution, and unmatched advisory services. With extensive experience in buy-side M&A in Korea, we help clients unlock the full potential of their investments while navigating market complexities with confidence.

Our tailored solutions for acquiring Korean companies ensure that your business secures high-value deals that align with your objectives. From deal sourcing to post-merger integration, JCinus supports you every step of the way to maximise value and minimise risks.

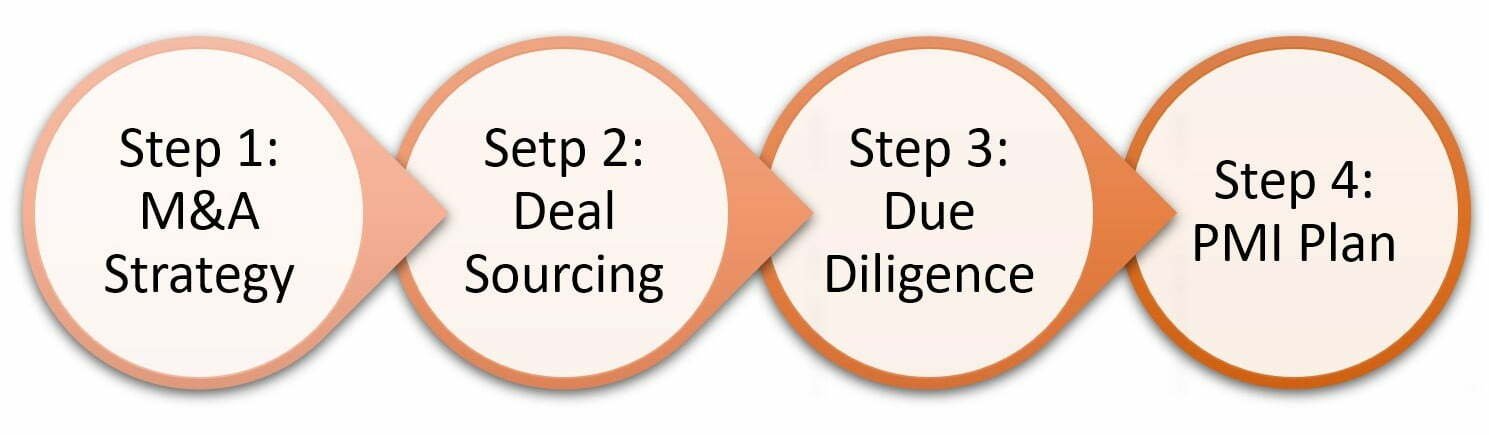

Understanding the Four Steps of the Acquisition Process

Step 1: Buy-side M&A Strategy

To acquire a company that could create synergies, you need a thorough acquisition strategy. Without a specific plan or strong commitment, the process may become time-consuming and ineffective.

In particular, acquiring a company incompatible with your core business may fail to generate synergies and lead to financial difficulties. A successful acquisition strategy should include:

- Designing a map of adjacent businesses and listing potential target companies in relevant industries to secure new growth engines.

- Defining the deal size range, identifying financial resources, and building a capital structure, including external funds.

- Organising an M&A task force (TF) team and assigning roles for efficient management of the deal process.

Step 2: M&A Deal Sourcing

Deal sourcing involves searching for target companies. There are several ways to source deals:

- Contacting M&A advisory firms with a potential sell-side list.

- Mobilising internal personnel networks, which is particularly effective for investment companies.

- Exploring private equity funds focusing on your sectors of interest.

- Creating a list of target companies and contacting them individually.

Each method has pros and cons. At this stage, you would conduct desk due diligence and simple valuation using teasers or confidential information memorandums (CIMs).

Step 3: Due Diligence (DD)

If desk due diligence and a submitted LOI are successful, you proceed to site due diligence. This phase involves:

- Commercial DD (CDD): Assessing whether the target company aligns with your core business and identifying deal-breaking risks.

- Financial DD (FDD): Reviewing assets, liabilities, contracts, taxes, and other critical areas with the help of accounting, tax, and legal professionals.

During due diligence, prepare a comprehensive PMI (Post Merger Integration) plan detailing the integration process, action phases, and restructuring to stabilise the organisation quickly.

Step 4: Post Merger Integration (PMI)

Once the stock purchase agreement is signed, and the balance paid, Day 0 marks the start of full-scale integration. By following the PMI plan created during due diligence, focus on:

- Achieving each phase’s goals outlined in the PMI report.

- Quickly integrating and restructuring to minimise potential losses.

- Valuing up the target company and generating synergies effectively.

Contact Us

Please feel free to send a message about our services. We will read it and reply to it soon.