Expert Korean Company M&A Advisory Services

Seamless Cross-Border M&A Solutions in Korea

Navigating M&A transactions in Korea requires local expertise, strategic insight, and a hands-on approach.

We specialise in Korean company M&A advisory, delivering tailored acquisition solutions that help foreign investors successfully enter and expand in the Korean market.

Comprehensive M&A Solutions for Acquiring Korean Companies

Your Strategic Partner for Cross-Border M&A Korea

JCinus is a leading Korean M&A advisory firm, providing end-to-end acquisition support for foreign investors looking to buy, merge, or partner with Korean companies. Our deep understanding of the local market, extensive industry networks, and strategic deal execution capabilities make us the ideal partner for Korean acquisition advisory.

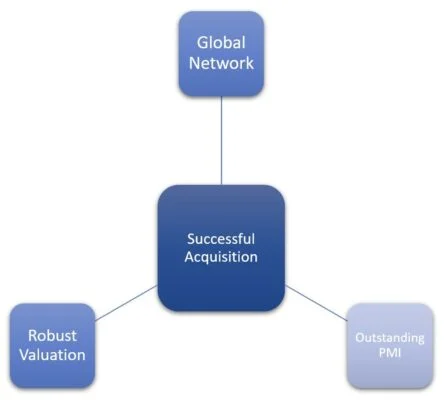

From target identification and valuation to negotiation, due diligence, and post-merger integration, we ensure every transaction is structured for success. Our M&A solutions in Korea are designed to mitigate risks, enhance deal value, and deliver long-term growth.

Why Choose JCinus for Korean Company M&A Advisory?

A Proven Approach to Cross-Border M&A Success

✔ Unmatched Expertise in Korean M&A

✔ Decades of experience in structuring, negotiating, and executing successful Korean company M&A advisory transactions.

✔ Deep industry knowledge across key sectors, including technology, healthcare, manufacturing, and energy.

✔ Exclusive Deal Sourcing & Market Access

✔ Strong local networks providing access to off-market acquisition opportunities.

✔ Direct connections with business owners, private equity firms, and industry leaders.

✔ End-to-End Transaction Support

✔ From target screening to post-merger integration, we guide clients through every phase of the M&A process.

✔ Expertise in financial modeling, due diligence, valuation, and regulatory compliance.

✔ Proven Track Record of Successful Cross-Border Transactions

✔ Helping foreign investors navigate the complexities of the Korean market with a structured approach.

✔ Ensuring strategic alignment, operational efficiency, and long-term value creation.

Unlock Value & Maximise Growth Through M&A in Korea

Unlock Value & Maximise Growth Through M&A in Korea

Achieve Strategic Success with JCinus M&A Advisory

Partnering with JCinus means securing a competitive edge in the Korean market through well-structured, strategic acquisitions. Our cross-border M&A Korea solutions ensure that every investment delivers tangible financial and operational benefits.

✔ Access to Exclusive Deals & Market Insights

✔ Proprietary deal pipeline offering off-market Korean acquisition opportunities.

✔ In-depth market intelligence for data-driven investment decisions.

✔ Reduced Transaction Risks & Optimised Deal Structuring

✔ Thorough financial due diligence, legal assessment, and valuation modeling.

✔ Expertise in mitigating cross-border regulatory challenges and compliance risks.

✔ Maximised Investment Returns & Corporate Growth

✔ Execution of post-merger integration strategies for seamless business transition.

✔ Implementation of Corporate Value-Up Strategies to enhance profitability and market positioning.

✔ Strategic Partnerships for Long-Term Success

✔ Hands-on advisory from deal initiation to post-acquisition management.

✔ Ongoing support for investors seeking continued expansion in Korea.

At JCinus, our goal is not just to facilitate M&A deals but to build long-term, sustainable success for our clients.

Contact Us

Please feel free to send a message about our services. We will read it and reply to it soon.