Strategic Deal Origination Korea

Find the Best Korean Companies to Acquire

Unlock Exclusive Opportunities with JCinus Deal Origination Korea.

Our meticulous approach to deal origination ensures that every transaction aligns

with your strategic goals and maximizes value creation.

Unlocking Cross-Border M&A Opportunities in Korea

JCinus Partners specialises in Korean company acquisition.

JCinus Partners specialises in deal origination Korea, providing unparalleled access to high-quality acquisition opportunities in South Korea. With a vast network and a structured approach, we help international businesses find Korean companies to acquire that align with their strategic growth objectives.

Our expert team offers Korean deal origination services designed to match global investors with the best M&A opportunities, ensuring a seamless transaction process. Whether you are looking for M&A deal origination in advanced industries like AI, pharmaceuticals, or manufacturing, or seeking a strategic deal origination for expansion, JCinus delivers unmatched expertise and precision.

Why Choose JCinus for Deal Origination Korea?

We are a Leading Deal Origination Company in Korea

Specializing in identifying and sourcing high-potential Korean companies to acquire for foreign investors, our team possesses a deep understanding of the Korean market, coupled with a global network, enabling us to connect you with the most promising investment opportunities.

1. Extensive Access to Hidden Opportunities

✔ Our deep-rooted presence in South Korea ensures we provide exclusive Korean deal origination services, uncovering hidden opportunities unavailable on public markets.

✔ We source, screen, and evaluate companies in various industries, ensuring our clients find Korean companies that fit their investment goals.

2. Industry-Specific Expertise

✔ Our deal origination Korea services focus on high-growth industries, including:

- AI technology and SaaS – Cutting-edge innovation hubs

- Pharmaceuticals and life sciences – High-value M&A deals in biotech

- Renewable energy – Access to South Korea’s green energy leaders

- Advanced manufacturing – Semiconductor and EV battery technology leaders

- Consumer goods and retail – Expanding access to the South Korean market

3. Tailored M&A Deal Sourcing Korea

✔ We develop a structured, step-by-step approach for M&A deal origination, ensuring companies get the best opportunities with minimal risk.

✔ Our personalised advisory helps clients secure a strategic acquisition Korea, aligned with their expansion and investment strategy.

4. Comprehensive Buy-side Support

✔ From identifying targets to post-merger integration, our deal origination Korea services cover every aspect of the M&A process.

✔ Our team ensures investors find Korean companies with optimal valuation, risk mitigation, and seamless negotiations.

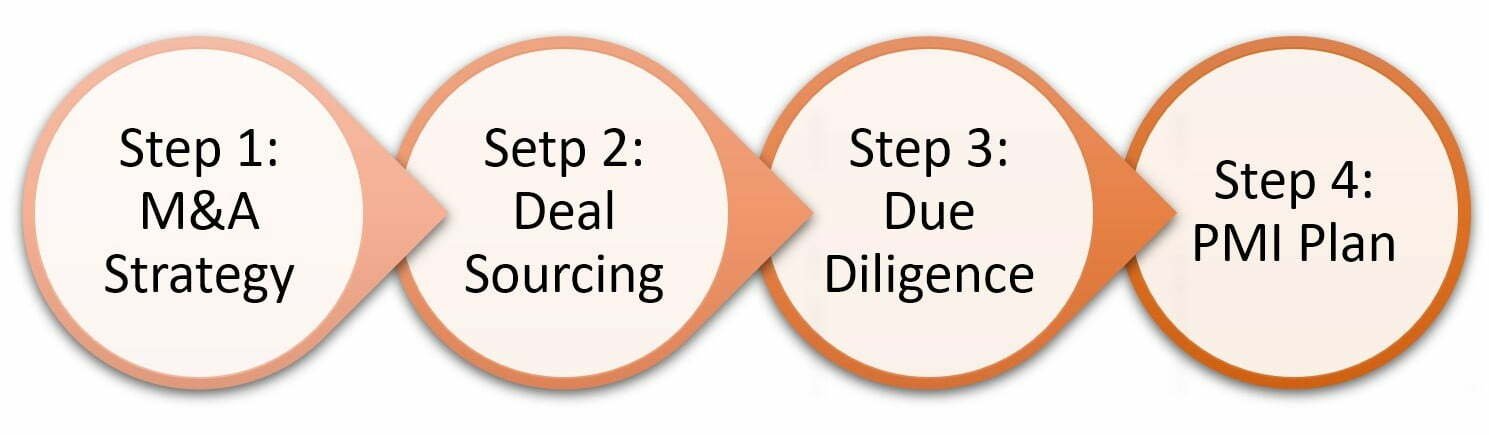

JCinus' 3-Phase Deal Origination Process

A Structured Approach for Confident and Efficient Deal Execution

1. Market Research & Target Identification

✔ We conduct in-depth market analysis to identify promising sectors for Korean deal origination.

✔ We develop an acquisition roadmap, defining investment criteria such as industry, company size, EBITDA margins, and strategic fit.

✔ Our advanced research methodologies ensure our clients efficiently find Korean companies that align with their business objectives.

2. Exclusive Deal Sourcing & Pre-Screening

✔ We leverage our M&A deal origination expertise to identify both on-market and off-market deals.

✔ Our proprietary network in South Korea provides access to companies not listed in public databases.

✔ We conduct initial screening, ensuring only qualified opportunities move forward for serious consideration in strategic deal origination.

3. Engagement & Negotiation Support

✔ We facilitate introductions and preliminary discussions with potential targets for deal origination Korea.

✔ Our experts assist in structuring offers, setting valuation benchmarks, and securing optimal deal terms.

With our hands-on guidance, investors successfully find Korean companies to acquire with confidence.

Contact Us

Please feel free to send a message about our services. We will read it and reply to it soon.