About JCinus Partners

Leading Korean M&A Advisory for Cross-Border Deals

JCinus Partners is a premier Korean M&A advisory firm specializing in guiding businesses through complex cross-border transactions and strategic investments in Korea.

We are dedicated to providing comprehensive and tailored solutions, leveraging our deep understanding of the Korean market, extensive network, and proven expertise in deal sourcing and execution.

Contact Us

Your Trusted Partner for Korean M&A Advisory & Strategic Investments

JCinus Partners specialises in Korean company acquisition.

JCinus Partners is a premier Korean M&A advisory firm, specialising in cross-border transactions, strategic investment Korea, and Korean deal sourcing. With a deep understanding of the Korean business landscape, we help foreign investors successfully navigate acquisitions, mergers, and strategic partnerships in Korea.

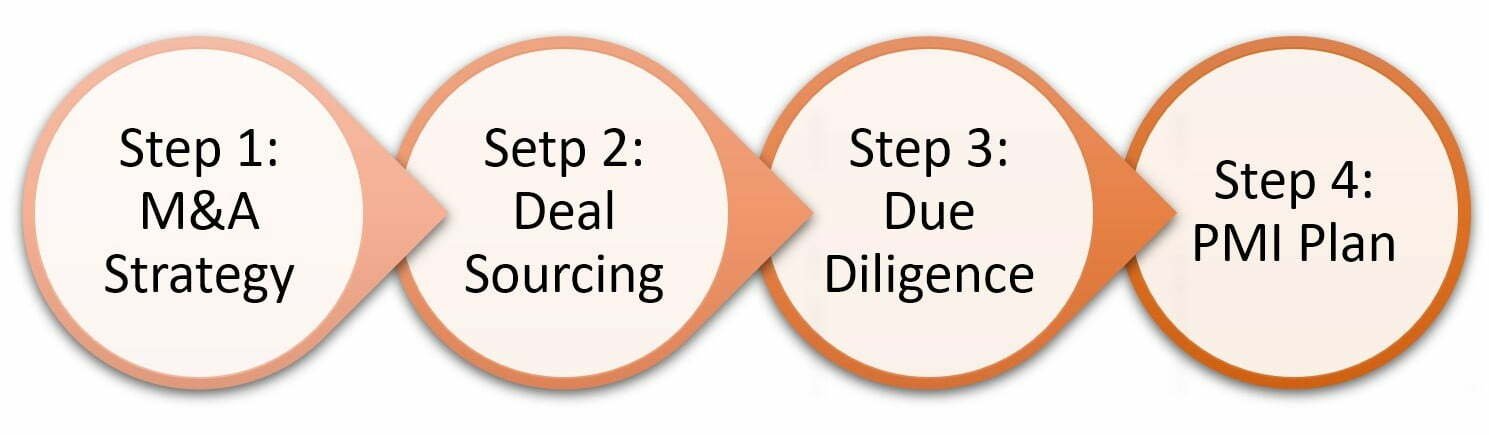

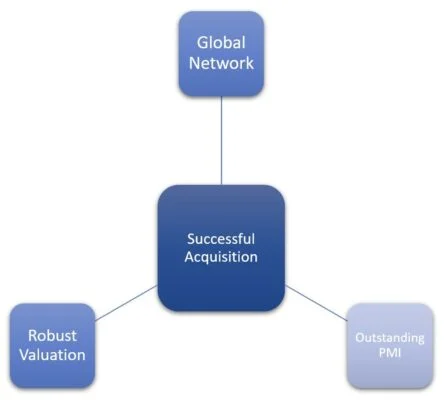

Our expertise lies in delivering end-to-end M&A solutions, from deal origination and valuation to negotiation, due diligence, and post-merger integration. As one of the leading M&A experts in Korea for cross-border deals, JCinus ensures that every transaction is structured for long-term success.

Who We Are: Leading M&A Experts in Korea

Your Trusted Partner for Korean M&A Success

At JCinus, we provide specialist M&A advisory services tailored to foreign companies looking to expand their presence in Korea. Our team consists of seasoned professionals with extensive backgrounds in corporate finance, investment banking, and cross-border transactions, enabling us to deliver high-value, strategic M&A solutions.

1. Korean Deal Sourcing with Exclusive Access

✔ Providing unparalleled access to exclusive off-market opportunities in Korea.

✔ Connecting international investors with high-potential Korean companies through a robust deal pipeline.

2. Expertise in Cross-Border M&A

✔ Bridging global investors with Korean companies through a seamless and structured M&A process.

✔ Managing every stage of acquisition, from initial negotiations to regulatory approvals.

3. Proven Success in Complex Acquisitions

✔ Structuring, negotiating, and executing sophisticated transactions with precision.

✔ Leveraging financial expertise to mitigate risks and optimise deal outcomes.

4. Deep Sector Knowledge & Strategic Insights

✔ Specialising in technology, healthcare, manufacturing, and renewable energy sectors.

✔ Delivering tailored investment strategies aligned with market trends and corporate objectives.

5. A Results-Driven Approach to M&A Success

✔ Ensuring seamless post-merger integration to maximise corporate value.

✔ Enhancing business performance through strategic synergy realisation and operational improvements.

Why Choose JCinus Partners?

We possess an unparalleled understanding of the Korean market, including industry dynamics, regulatory landscape, and cultural nuances.

Our extensive network of contacts and partners in Korea enables us to identify and access the best opportunities for our clients.

Our team has a proven track record of advising on successful Korean M&A transactions across various sectors.

1. Exclusive Korean Deal Sourcing & Market Access

- Strong local connections to secure off-market opportunities.

- Extensive industry networks with business owners, financial institutions, and strategic investors.

2. Specialised Cross-Border M&A Expertise

- Proven track record in Korean M&A advisory for international clients.

- Deep knowledge of Korean regulations, business culture, and investment frameworks.

3. Strategic Investment Korea & Value Creation

- Maximising acquisition value through strategic restructuring and operational enhancement.

- Implementing Corporate Value-Up Strategies to drive profitability and business scalability.

4. Hands-On Deal Execution & Post-Merger Integration

- Managing due diligence, valuation, and negotiations for optimal deal structuring.

- Providing comprehensive post-merger integration support to ensure seamless transitions.

Expanding Your Investment Footprint in Korea

Korea is one of Asia’s most dynamic markets for M&A and strategic investments. As a leading M&A expert in Korea for cross-border deals, JCinus enables investors to capitalize on high-growth industries, including:

1. Technology & AI-Driven Businesses

- Investment in next-generation artificial intelligence and cloud computing firms.

- Supporting innovative tech startups and established enterprises in Korea’s digital transformation.

2. Pharmaceuticals & Life Sciences

- Partnering with biotech leaders in cutting-edge drug development and medical advancements.

- Capitalizing on the growth of personalized medicine and digital health innovations.

3. Renewable Energy & Sustainable Solutions

- Investing in Korea’s growing renewable energy sector, including solar, wind, and hydrogen.

- Driving sustainable infrastructure and green energy projects to support global ESG initiatives.

4. Consumer Goods & Advanced Manufacturing

- Supporting investments in Korea’s fast-growing e-commerce and retail sectors.

- Enhancing efficiency and global competitiveness in advanced manufacturing and supply chain industries.

By leveraging our deep market knowledge, strategic relationships, and data-driven insights, we help clients successfully navigate Korean M&A and unlock opportunities in this competitive landscape.

Contact Us

Please feel free to send a message about our services. We will read it and reply to it soon.