Seamless Korean Company Integration for Maximum Value

Maximise Post-Merger Success and Corporate Value in Korea

Unlock the full potential of your Korean acquisition with JCinus Partners.

We provide expert post merger integration and corporate value-up strategies tailored for successful Korean company integration.

Expert Korean Company Integration Services by JCinus

Achieve Sustainable Growth and Value Enhancement in Korea

Merging with or acquiring a Korean company is just the beginning—true success lies in seamless Korean company integration. At JCinus, we specialise in post merger integration Korea, ensuring foreign investors increase operational efficiency and enhance corporate value in South Korea. Our tailored Corporate Value-Up Strategy helps you increase Korean company value and establish a strong foundation for long-term growth.

We provide comprehensive Korean company integration services designed to ensure that M&A transactions in Korea deliver tangible and lasting results. Many acquisitions fail due to poor integration planning, cultural mismatches, or operational inefficiencies. We help foreign investors navigate these challenges through post-merger integration Korea strategies that drive efficiency, workforce alignment, and value creation.

Our team specialises in creating Corporate Value-Up Strategies that enable companies to increase Korean company value while ensuring a seamless transition. By aligning management structures, integrating corporate cultures, and optimising financial and operational performance, we provide a structured roadmap for post-M&A success in Korea.

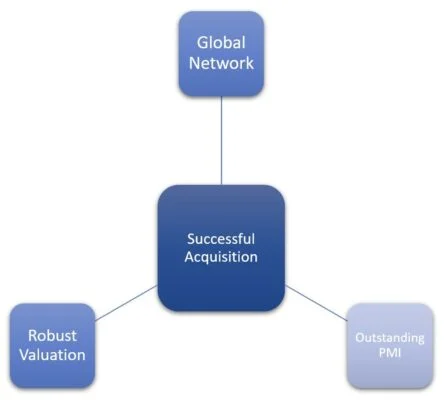

Why Choose JCinus for Korean Company Integration?

Specialised M&A and Corporate Value Enhancement in Korea

1. Proven Expertise in Post-Merger Integration Korea

✔ We have successfully guided numerous foreign investors through complex Korean company integration projects.

✔ Our structured approach ensures that every aspect of post-M&A transition is handled with precision.

2. Strategic Corporate Value-Up Solutions

✔ We design tailored Corporate Value-Up Strategies to enhance financial performance, increase operational efficiency, and secure market expansion.

✔ Our methods focus on increasing Korean company value by strengthening core business functions post-acquisition.

3. Comprehensive Cross-Border M&A Support

✔ Our expertise extends beyond integration to cover strategic M&A planning, valuation, and deal structuring.

✔ We mitigate risks and optimise deal synergies, ensuring long-term sustainability for foreign investors in Korea.

4. Deep Market Insights & Local Network

✔ JCinus has extensive knowledge of the Korean business landscape, regulatory requirements, and cultural dynamics.

✔ Our local expertise ensures that foreign companies achieve a successful Korean company integration while maximising corporate value.

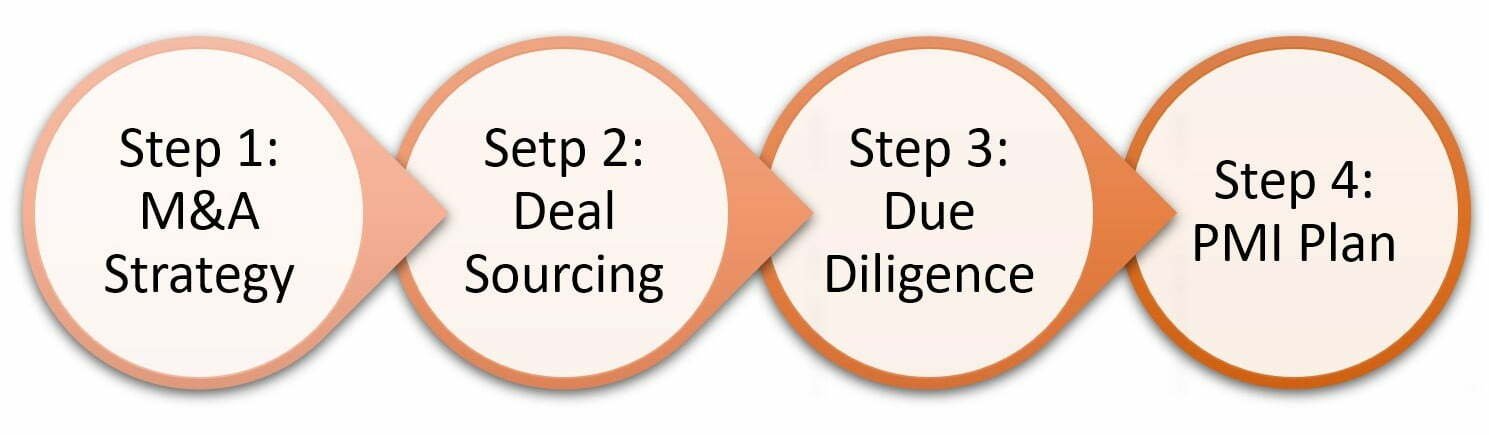

JCinus’ Structured Approach to Korean Company Integration

From Due Diligence to Corporate Value Enhancement

JCinus follows a meticulous and structured process to ensure successful Korean company integration. Our approach is designed to provide clarity, efficiency, and strategic direction to foreign investors seeking post-merger integration Korea solutions.

1. Comprehensive Due Diligence

✔ We conduct in-depth due diligence to gain a thorough understanding of the acquired Korean company, including its operations, financials, culture, and market position.

✔ This forms the foundation for a successful post-merger integration Korea.

2. Strategic Integration Planning

✔ We develop a customized integration roadmap that outlines key milestones, timelines, and resource allocation.

✔ This ensures alignment with your strategic goals and maximizes Korean company value enhancement opportunities.

3. Cultural Integration

✔ We facilitate a smooth cultural integration by fostering communication, collaboration, and mutual understanding between the two organizations.

✔ This minimizes disruption and maximizes employee engagement.

4. Operational Integration

✔ We streamline operations, optimize processes, and integrate systems to achieve operational efficiencies and enhance productivity.

✔ This drives Korean company value enhancement.

5. Value Creation & Monitoring

✔ We identify and implement Korean company value enhancement initiatives.

✔ Our team tracks key performance indicators and provides ongoing support to ensure the long-term success of your Korean acquisition.

By following this structured approach, JCinus ensures that your acquisition in Korea transitions smoothly, maximising business stability and long-term success.

Contact Us

Please feel free to send a message about our services. We will read it and reply to it soon.