Strategic Principal Investment

Long-Term Capital Investment for Maximum Value Creation

We specialise in principal Investment, deploying capital into high-growth sectors to drive long-term value,

driving long-term growth and maximizing returns through strategic asset allocation and operational expertise.

Building Value Through Principal Investment

Long-Term Growth Through Strategic Capital Allocation

We focus on long-term capital investment in high-growth companies with a strong commitment to innovation and sustainable practices. Our strategic asset allocation focuses on acquiring, managing, and growing businesses with strong fundamentals and high potential. By leveraging our expertise in equity investment, we ensure our portfolio companies achieve sustainable expansion and market leadership.

JCinus’s Principal Investment strategy is focused on long-term capital investment in high-growth sectors such as technology, healthcare, energy, and sustainability-driven industries. Our expertise in equity investment and deep market insights enable us to identify good business investment opportunities that generate substantial returns. We actively engage in corporate strategy, financial restructuring, and operational improvements to maximise value across our portfolio. By aligning our interests with the long-term success of our investments, JCinus provides a unique blend of financial expertise, operational support, and industry leadership.

Why Are We So Good at Managing Principal Investments?

Why Are We So Good at Managing Principal Investments?

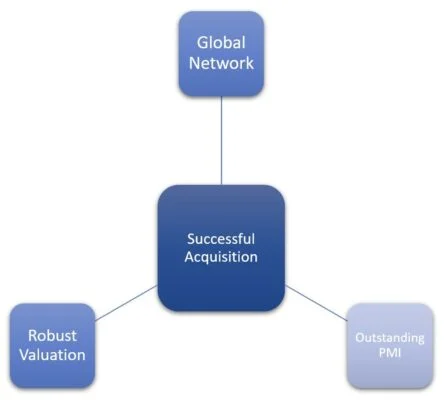

A Proven Strategy for Long-Term Capital Growth

Our principal investment approach is built on deep market insight, rigorous due diligence, and active value creation. We don’t just invest—we identify transformative opportunities, optimise performance, and drive sustainable growth. By combining strategic resource allocation with hands-on operational expertise, we consistently maximize returns while mitigating risks.

1. Strategic Vision & Market Foresight

✔ We proactively identify and capitalize on emerging trends before they become mainstream.

✔ Our investment strategy is built around long-term capital investment, ensuring sustained value creation.

✔ We target sectors with high innovation potential, positioning our portfolio companies for future success.

2. Rigorous Due Diligence & Risk Management

✔ Every equity investment undergoes a thorough, multi-stage vetting process to minimize risks.

✔ We conduct in-depth financial, operational, and strategic analysis before deploying capital.

✔ Our risk assessment framework ensures we back only the most resilient, scalable businesses.

3. Active Value Creation & Performance Optimisation

✔ We go beyond capital allocation by directly engaging with portfolio companies to enhance their performance.

✔ Our team supports businesses in corporate restructuring, operational efficiencies, and strategic leadership.

✔ By aligning with management teams, we unlock hidden value and accelerate growth trajectories.

4. Global Network & Unmatched Deal Flow

✔ Our extensive global connections give us access to exclusive investment opportunities.

✔ We leverage international insights to secure cross-border investments with strong growth potential.

✔ Our ability to spot opportunities ahead of the market gives our portfolio a competitive edge.

5. Alignment of Interests & Long-Term Partnerships

✔ We invest with a long-term perspective, ensuring our success is tied to our portfolio companies’ performance.

✔ Our philosophy is centered on shared growth, fostering strong relationships with investors and business leaders.

✔ By focusing on good business investment, we build sustainable value that benefits all stakeholders.

At JCinus, Principal Investment is more than just deploying capital—it’s about strategic vision, value creation, and long-term success.

A Structured Approach to Principal Investment

A Structured Approach to Principal Investment

From Strategic Planning to Value Maximisation, JCinus follows a meticulous and disciplined approach to Principal Investment, ensuring optimal value creation at every stage.

1. Sourcing & Screening

✔ We leverage our extensive network and industry expertise to source a diverse range of principal investment opportunities.

✔ We conduct thorough initial screening to identify companies that align with our investment criteria and offer compelling growth potential.

2. Due Diligence & Valuation

✔ We perform in-depth due diligence to gain a comprehensive understanding of the target company’s business model, financial performance, competitive landscape, and management team.

✔ This includes detailed financial analysis, market research, and operational assessments.

✔ We conduct a rigorous valuation analysis to determine a fair investment price and assess potential returns.

3. Investment Execution & Structuring

✔ We structure our principal investments to align with the specific needs of the target company and our investors.

✔ This may involve various equity investment instruments, including minority or majority stakes, growth equity, or buyout transactions.

✔ We negotiate terms that are mutually beneficial and support the long-term growth of the company.

4. Value Creation & Portfolio Management

✔ We work closely with our portfolio companies to implement value creation initiatives, optimize operations, and accelerate growth.

✔ This includes providing strategic guidance, operational support, and access to our network of industry experts.

✔ We actively monitor the performance of our portfolio companies and provide ongoing support to ensure their success.

5. Exit Strategies

✔ We develop and execute exit strategies that maximize returns for our investors.

✔ This may involve strategic sales, initial public offerings (IPOs), or recapitalizations.

✔ Our timing and approach to exits are carefully considered to achieve optimal outcomes for all stakeholders.

By following this structured approach, JCinus maximises the potential of Principal Investment, ensuring sustainable value creation across all investment cycles.

Contact Us

Please feel free to send a message about our services. We will read it and reply to it soon.