Business expansion through a company acquisition in South Korea

JCinus has a strong pipeline in South Korea. You will create incredible synergies by taking over a Korean business where state-of-the-art technology abounds.

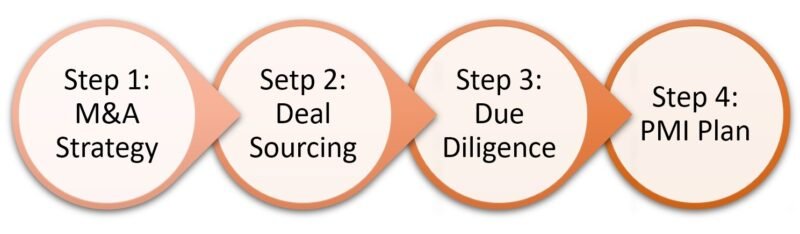

Acquisition process may vary depending on the type of company sales such as tender offer, selective disclosure, or private contact. However, it can generally be divided into four steps.

In order to acquire a company that could create synergies, you should set up a thorough acquisition strategy. It could be time-and-energy-consuming if you approach it just with simple interest, not a specific plan or strong willingness.

In particular, acquiring a company that is not compatible with your core business may not generate synergy and may face financial difficulties.For a successful company acquisition, you need to stick to the following points:

The next step is searching for target companies. There would be four ways to source deals:

Each method has its own pros and cons. At this stage, you would conduct desk due diligence as well as simple valuation with a teaser or CIM of a target company.

If you are interested in the deal through the desk DD and then submit an LOI, you will conduct the site DD.

There are two DDs in here; Commercial DD(CDD) and Financial DD(FDD). Usually, after CDD, you get into an MOU with the counterpart and conduct FDD. But sometimes the deal goes into both DDs together simultaneously depending on the deal-sales type.

CDD is a process in which you usually examine whether the target company is suitable for your core business or company. You also need to find any risk of dropping the deal. Just before CDD, the M&A TF team should hand the counterpart a list of data room to study and review.

Upon completion of CDD, you can enter an MOU. The MOU should include essential matters that will go into the stock purchase agreement. Then, you will run FDD with an accounting firm, a tax firm, and a law firm. In this step, you will examine the assets and liabilities of the target company, the contracts, taxes, and others.

Most importantly, many often overlook, but at this step, you should write a full-fledged PMI(Post Merger Integration) report. In other words, you should define each phase after the acquisition and make a detailed action plan on how to carry out integration with your company.

The reason this is critical is to quickly take over the business, prevent key human resources from leaving, and create synergies as soon as possible. Also, if necessary, you need to exercise rapid restructuring to stabilise the organisation as quickly as possible.

If you sign a stock purchase agreement and pay the balance of the deal price, it becomes Day 0. From this point on, you will execute full-scale integration work. By the PMI plan that you set up during DDs, you should make all efforts to value up the target company.

The faster and more accurate the integration and restructuring, the less the potential losses. You need to achieve each goal at each phase planned in the PMI report.

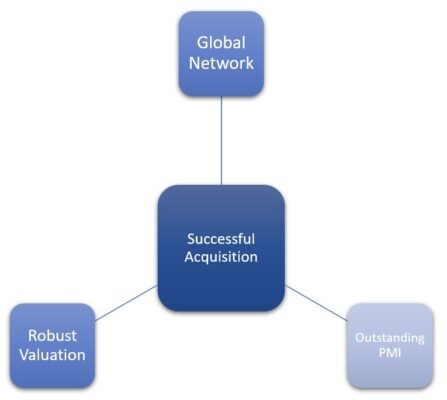

The chances of completing one acquisition are low. However, it is more challenging to improve the acquired company value. A successful investment is not merely about taking over a company but creating synergies with it. As success factors for that:

Our capabilities are robust. Our three competencies will help our clients successfully acquire a business.

Our capabilities are robust. Our three competencies will help our clients successfully acquire a business.

We are powerful in deal sourcing. We have been building a strong pipeline in Korea. We can carry out cross-border deals for our British corporate clients to expand the business to Korea as well as Asia.

The clients will take over a synergy-creating business in Korea through our differentiated deal sourcing.

We are all a valuation specialist. Also, as important as valuation is negotiation skill to persuade the counterpart to our advantageous position with robust logic. The goal is, after all, to pay a less price than the value.

We can also efficiently organise a TF team and well-place them in the procedures of due diligence. You will know any risks in advance through our DD and hedge and get rid of them promptly.

What we are proud of is that we can build an elaborate strategy before and after an M&A deal. By planning thorough takeover strategies, our clients will clarify the justification of the deal and lower the takeover risks.

During due diligence, we will make the report about post merger integration and proceed with integration on time after D-day. That work will prevent the churn of talent in advance and help synergies to take effect within 100 days.

We also run ‘MAI’, an M&A training website. MAI (Mergers & Acquisition Institute) specialises in M&A training and community.

이 소식을 신고하는 중에 문제가 발생했습니다.

이 회원을 차단할 것인지 확인하십시오.

더 이상 다음을 수행할 수 없습니다.

참고: 이 작업은 또한 연결에서 이 구성원을 제거하고 사이트 관리자에게 보고서를 보냅니다. 이 프로세스가 완료되는 데 몇 분 정도 소요됩니다.