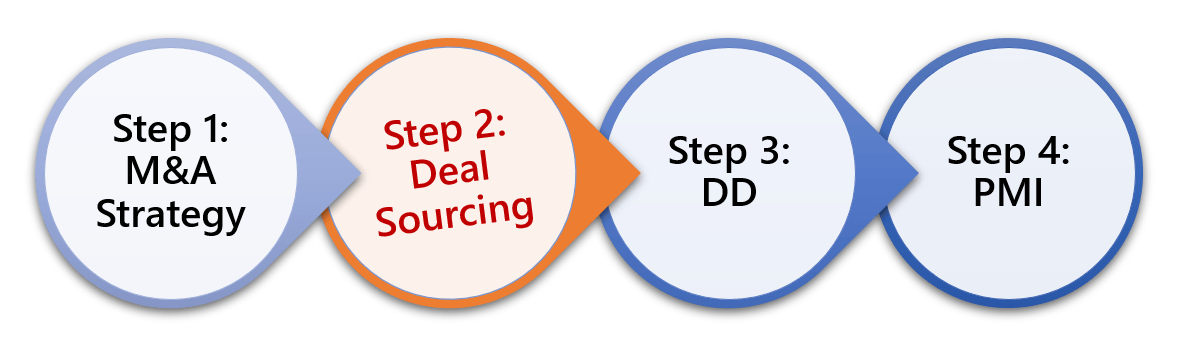

We provides a global M&A deal origination service.

We specialise in discovering promising Korean companies for clients wishing to advance into Asia.

Reasonable valuation is fundamental to negotiation.

JCinus, which has conducted corporate valuation in various fields, performs a stress test by analysing the factors that would influence the sales increase or decrease in the future.

That provides a basis for deal negotiation and also helps identify post-acquisition risk factors and plans to mitigate them.

Due diligence is not only a company-wide analysis but also a task to discover what to discuss in negotiations.

It is necessary to select the data room to be analysed, conduct Q&A with the right people for critical issues, and identify key personnel and establish a plan to prevent them from leaving the company.

By organising and doing all of this, our clients can mitigate the M&A risk.

It is difficult to close one M&A deal, but it is even more difficult to increase the target company’s value after acquisition.

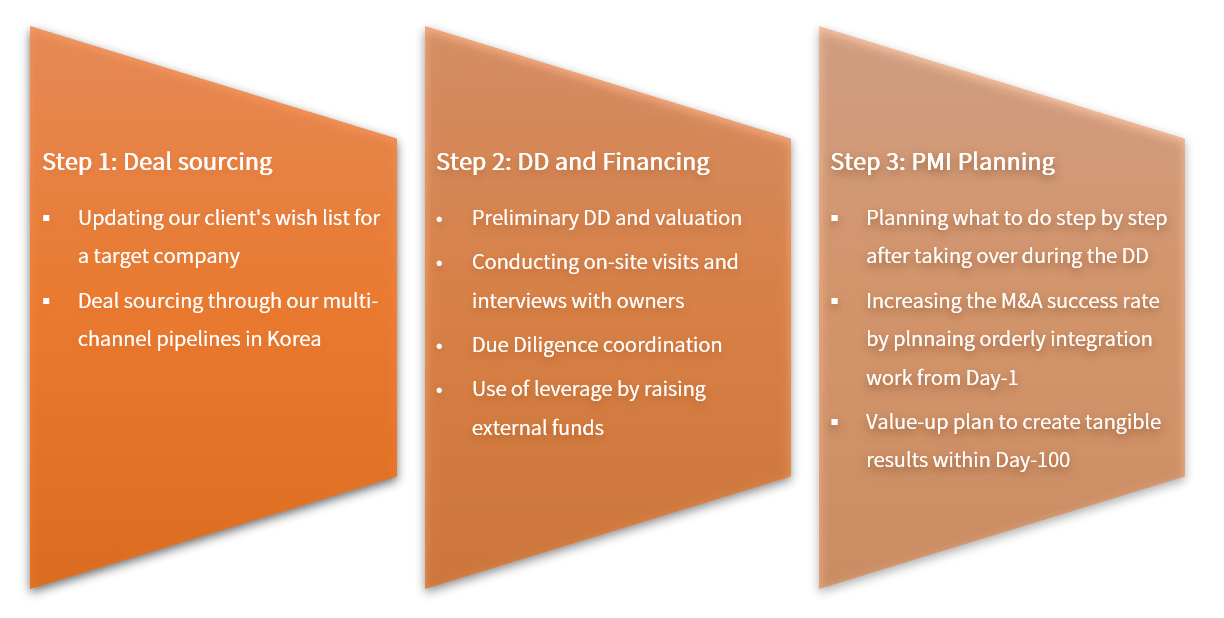

During the DD, we organise a PMI plan and value-up strategies to get quick wins within the 100 days after acquisition.

It will reduce the confusion time caused after M&A and significantly increase the integration success rate.

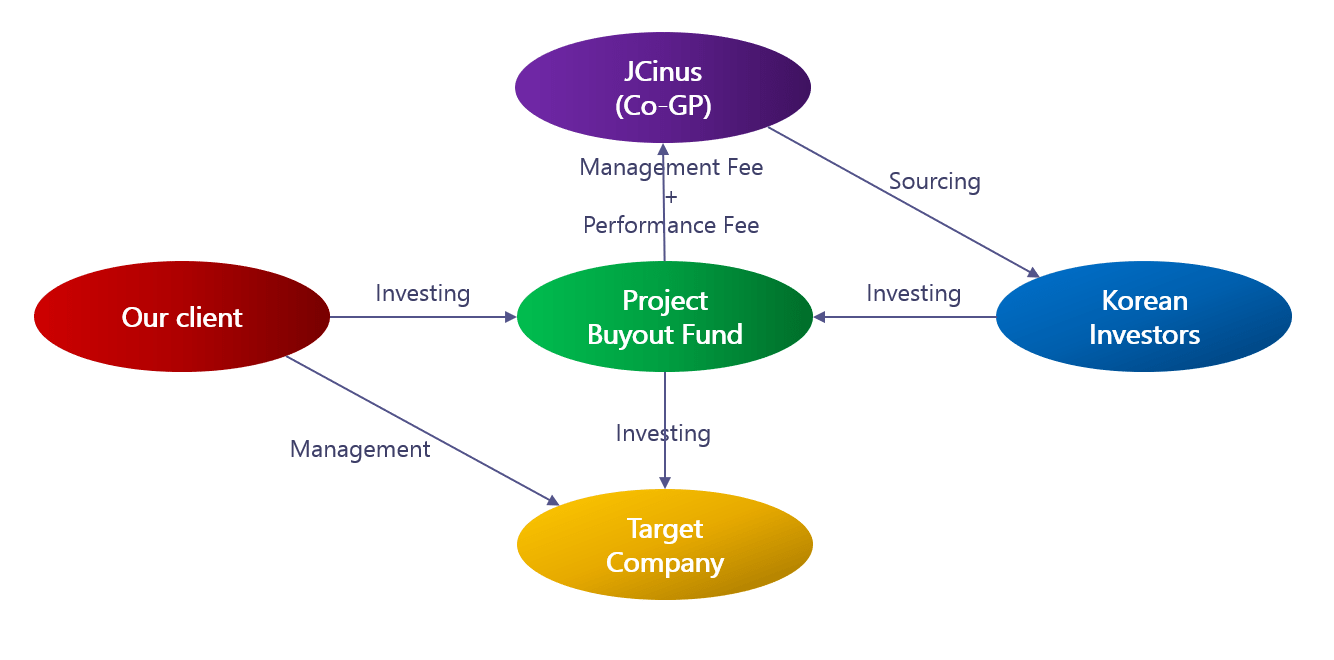

JCinus can find financial or strategic institutions when our clients need more financing for the acquisition.

If necessary, we establish a unique capital structure to double the leverage effect that allows clients to do larger deals than equity capital.

Acquisition financing structure sample

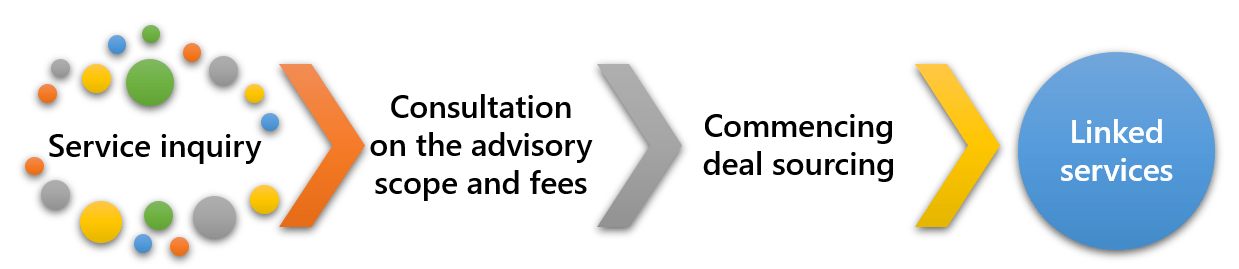

Please contact us through the message box if you have any questions or requests for our M&A deal origination service. We will contact you shortly.

Please let us know your questions about our M&A deal origination or related issues in the message box. We will contact you shortly.

Or send directly to: admin@jcinus.com

The advisory fee is calculated considering the sector and business our clients are targeting and related conditions. The fee is divided into retainer fee and success fee.

Depending on the deal size and job difficulty, the retainer fee will be decided, and the success fee at 1.5% ~ 5.0% of the deal size. (excluding VAT)

We get into an ‘advisory agreement’ when all terms and conditions are agreed upon between us.

In principle, the retainer fee should be paid immediately after the contract is signed, and the success fees within two weeks after signing the acquisition contract for the target company.

After signing the contract and being paid the retainer fee, our service begins.

In general, we organise a list of candidates together with our clients and then operate several pipelines to start discovering the targets.

We can provide linked services under a separate contract when our clients need additional advisory.

These include corporate valuation, DD for the target company, PMI planning during the DD, and acquisition financing from external financial institutions.

The client will pay 1.5% ~ 5.0% of the deal size as a success fee within two weeks after the end of the deal.

And the contract ends.

Send us a message with any query about our deal origination service. We will read it and get back to you soon.

We also run ‘MAI’, an M&A training website. MAI (Mergers & Acquisition Institute) specialises in M&A training and community.

이 소식을 신고하는 중에 문제가 발생했습니다.

이 회원을 차단할 것인지 확인하십시오.

더 이상 다음을 수행할 수 없습니다.

참고: 이 작업은 또한 연결에서 이 구성원을 제거하고 사이트 관리자에게 보고서를 보냅니다. 이 프로세스가 완료되는 데 몇 분 정도 소요됩니다.